Free Quote

Use the form below to request a free home insurance quote. We’ll shop for the best coverage options and rates for you.

Request a Home Insurance Quote

Buying the right homeowners insurance policy isn’t as easy as it used to be. Some companies offer better coverage than others, some exclude or limit things you would expect to be covered, and some carriers have non-renewed or are no longer issuing new policies in the state. As a result, finding a great home insurance rate with a reputable carrier has become more difficult in recent years.

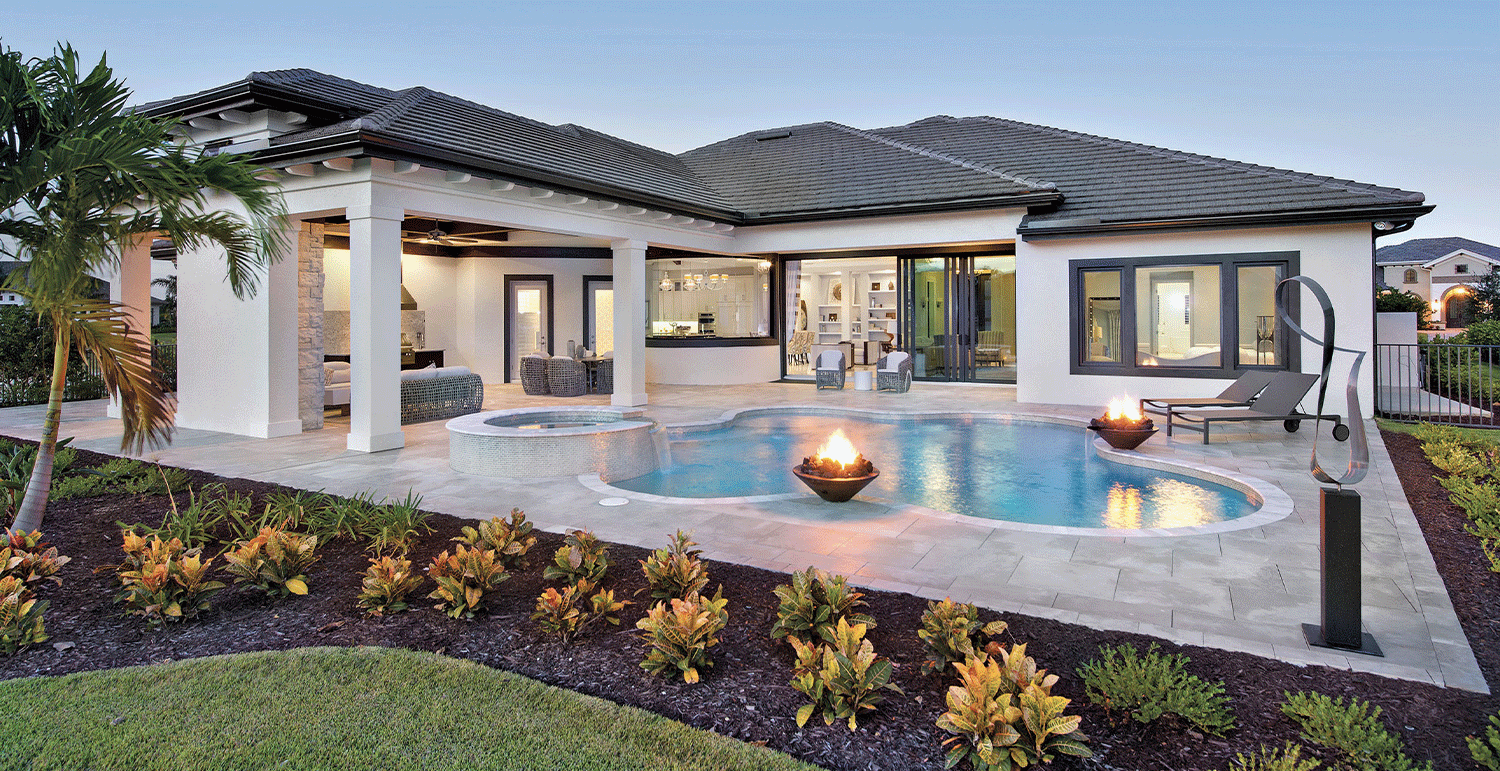

Typically, a house is the most valuable asset a person owns. So, it is very important that it is protected and covered by insurance. Remember replacing or repairing your property is just a part of your need for protection as a home owner. Your Port Charlotte home insurance policy should also be carrying the right amount of liability coverage to ensure that you and your family are covered in case of a disaster.

Port Charlotte is prone to windstorms and hurricanes, that’s why house owners here must have a reliable homeowners insurance to protect their property.

In addition, expensive home amenities and high-valued personal belongings contained in your home should also be considered for additional coverage. So, take time today to ensure your policy affords the protection you need should the unexpected happen. Call our office to speak directly with an agent or use our website’s convenient contact form to have a representative explain your options for homeowner’s insurance.

We’ll work with you to understand your personal needs, and help to find a great rate with a company that will be the best fit for your families home.

Compare homeowners insurance quotes from every top insurance company.

Your information is completely secure and never shared.

With hundreds of satisfied South Florida clients, Ezzi Insurance Advisors is here for you & your family.

Frequently Asked Home Insurance Questions

At a minimum, homeowners insurance usually covers damage caused by:

- Fire or lightning

- Windstorm or hail

- Explosions

- Aircraft

- Vehicles

- Smoke

- Theft or vandalism

- Falling objects

Covered personal property includes the contents of your home and personal belongings used, owned, worn or carried by you or members of your household-basically, everything and the kitchen sink! This coverage is also based on the house coverage, and there are limits on the losses that can be claimed. Higher limits can be purchased for both real and personal property.

- Actual Cash Value. The replacement cost of the item minus depreciation. For example, a new television set may cost $500. But if your 7year-old TV set gets damaged in a fire, it might have depreciated 50 percent prior to the damage. Therefore, you would be paid $250 for that set.

- Replacement Coverage. The cost of replacing an item without deducting for depreciation, but limited to a maximum dollar amount. Today’s cost for a TV set with features similar to the 7-year-old one damaged by fire would determine the amount of compensation. If it still costs $500 today, that would be the replacement coverage. (It’s important to remember that there are limits on this policy and you need to keep up-to-date on your coverage).

- Extended Replacement Cost. An extended replacement cost policy, one that covers costs up to a certain percentage over the limit (usually 20%). This gives you protection against such things as a sudden increase in construction costs.

Important Note: Replacement value should not be confused with market value. The market value is what your house, for example, would actually sell for and is generally more than the replacement cost. This is because replacement value does not include the land-which almost always does not need to be replaced.

Check your policy. If you prefer replacement or extended replacement coverage and do not already have it, this coverage can be added to your policy. Typically, the difference in premiums is 10 to 15 percent to upgrade from actual cash value coverage to replacement coverage. Your agent can advise you of the costs and benefits.

The liability component also extends well beyond the boundaries of your home. Should you be found legally at fault for injury or loss to another individual, whether you unfortunately and unintentionally cause a tumble down a California hill or a fall in an Indiana barn, for example, your homeowners policy likely will cover you.

As in the property section of a homeowners policy, there are limits and exclusions to personal liability. Your business activities, for example, are not covered under your homeowners policy. You also are not covered for injuries or damage you deliberately cause. Your policy lists specific exclusions and limits.

Free Home Insurance Quote

Ensure your property’s value long-term. We’ll shop for the best coverage options and rates for you.